BETA

Trusted by 400+ funds and companies globally

WHAT

Most Complete Investor Database

Individual data platforms are faulty, but combined together, we can have a clear picture of what the investment industry looks like.

Multi Channel Sourcing

We aggregate data from leading data sources such as Linkedin, Preqin, PitchBook, Nvestiv, Fintrx, Crunchbase, Apollo, Zoominfo, SEC EDGAR, and other Web publications.

with investment mandates and contact info

We draw data from 34+ data sources such as investor databases, LinkedIn, news sites, etc.

AI Data Analysis

Machine learning identifies gaps in individual data streams, and enriches the data into its best form. We combine and improve the scattered data for you.

9.2%

properties automatically enriched

Data Mapping

combines data from all providers

AI powered Enriching

corrects errors and keeps up to date

USER JOURNEY

How CapitalNinja Works

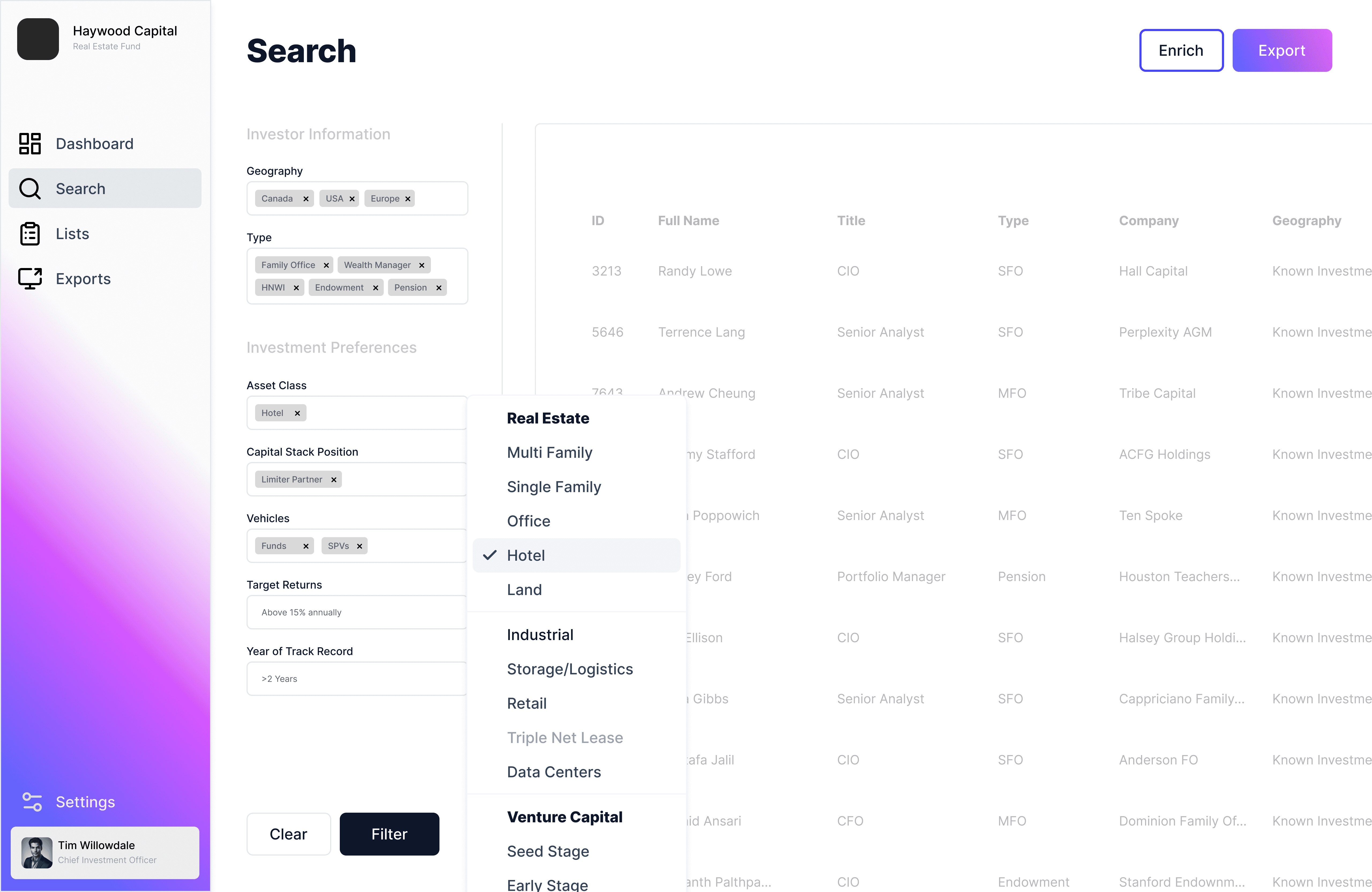

Search & Filter

Isolate target investors by 30+ parameters such as investor type, asset class, prior investments, region, ticket size, and more.

Create Lists

Export target investor lists to CSV or JSON, import into your favorite email system, and start sending them your pitches.

Export & Pitch

Export target investor lists to CSV or JSON, import into your favorite email system, and start sending them your pitches.

AI Email Campaigns

Email drip campaign that writes outreach copy that is personalized to each investor on your list using the power of AI.

DataSet

Breaking Down the Investor Database

Angels & Venture Capital

Individuals who provide funding to startups, often prior founders or employees at startups. VCs are experienced in venture capital or early-stage investments, with a mandate to find emerging startups.

Accredited HNWIs

Accredited HNWIs include professionals such as doctors, lawyers, and engineers, as well as ultra-high-net-worth individuals seeking diversified investment opportunities.

Single Family Offices

Single Family Offices are private wealth entities managing the assets of ultra-wealthy families, focusing on public and/or private investments for generational wealth creation and preservation.

Multi-family Offices

Multi-Family Offices manage the wealth of multiple families, often pooling Family Offices or acting as specialized wealth managers for family offices.

Institutional Investors

Institutional investors include pensions, insurance companies, endowments, and banks, deploying significant capital into scalable and risk-adjusted opportunities.

Lenders

Lenders span funds and private entities providing debt financing across the capital stack, including senior-secured, mezzanine, and bridge loans.

PRICING

Start making smarter decisions.

Choose a plan

Startup

For Solo Founders & Growing Startups

$ 275

USD per month

Angel Investors & Venture Capital Firms

Unlimited Users

100 Monthly Exports

Data Enrichment add-on

24/7 Email Support

Standard

Popular

For Emerging Fund Managers ready to scale

$ 2000

USD per month

HNWIs, Family Offices, Wealth Managers, Institutional Investors

Unlimited Users

100 Monthly Exports

Data Enrichment (add-on)

24/7 Email Support

Premium

For Institutional Quality Asset Managers

$ 5000

USD per month

Everything in Standard plan

AI Email Outreach

500 Monthly Exports

Data Enrichment Included

24/7 Email Support

All plans billed annually

Ongoing data updates

Support included